Advertisement

-

Published Date

November 15, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

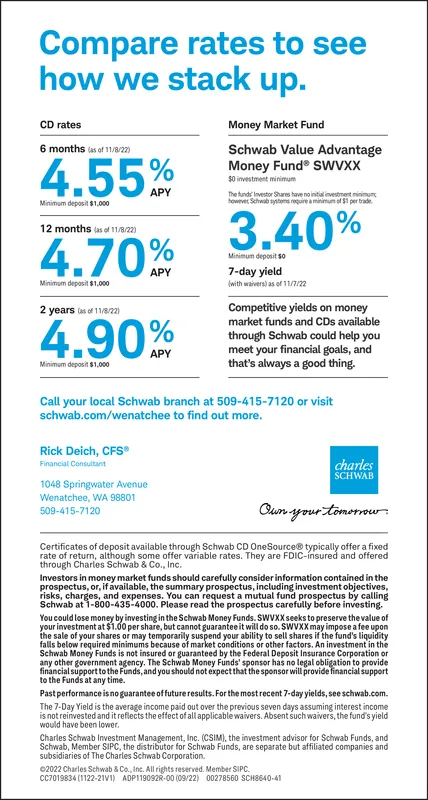

Compare rates to see how we stack up. CD rates 6 months (as of 11/8/22) 4.55% Minimum deposit $1,000 12 months (as of 11/8/22) 4.70% Minimum deposit $1,000 2 years of 11/8/22) 4.90% Minimum deposit $1,000 Rick Deich, CFS Financial Consultant Money Market Fund Schwab Value Advantage Money Fund SWVXX $0 investment minimum The funds Investor Shares have no initial investment minimum however Schwab system require a minimum of 51 per trade 3.40% 1048 Springwater Avenue Wenatchee, WA 98801 509-415-7120 Minimum deposit so 7-day yield (with waivers) as of 11/7/22 Call your local Schwab branch at 509-415-7120 or visit schwab.com/wenatchee to find out more. Competitive yields on money market funds and CDs available through Schwab could help you meet your financial goals, and that's always a good thing. charles SCHWAB Own your tomorrow. Certificates of deposit available through Schwab CD OneSource® typically offer a fixed rate of return, although some offer variable rates. They are FDIC-insured and offered through Charles Schwab & Co., Inc. Investors in money market funds should carefully consider information contained in the prospectus, or, if available, the summary prospectus, including investment objectives, risks, charges, and expenses. You can request a mutual fund prospectus by calling Schwab at 1-800-435-4000. Please read the prospectus carefully before investing. You could lose money by investing in the Schwab Money Funds. SWVXX seeks to preserve the value of your investment at $1.00 per share, but cannot guarantee it will do so. SWVXX may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. An investment in the Schwab Money Funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Schwab Money Funds' sponsor has no legal obligation to provide financial support to the Funds, and you should not expect that the sponsor will provide financial support to the Funds at any time. Past performance is no guarantee of future results. For the most recent 7-day yields, see schwab.com. The 7-Day Yield is the average income paid out over the previous seven days assuming interest income. is not reinvested and it reflects the effect of all applicable waivers. Absent such waivers, the fund's yield would have been lower. Charles Schwab Investment Management, Inc. (CSIM), the investment advisor for Schwab Funds, and Schwab, Member SIPC, the distributor for Schwab Funds, are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. ©2022 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. CC7019834 (1122-21V1) ADP119092R-00 (09/22) 00278560 SCH8640-41 Compare rates to see how we stack up . CD rates 6 months ( as of 11/8/22 ) 4.55 % Minimum deposit $ 1,000 12 months ( as of 11/8/22 ) 4.70 % Minimum deposit $ 1,000 2 years of 11/8/22 ) 4.90 % Minimum deposit $ 1,000 Rick Deich , CFS Financial Consultant Money Market Fund Schwab Value Advantage Money Fund SWVXX $ 0 investment minimum The funds Investor Shares have no initial investment minimum however Schwab system require a minimum of 51 per trade 3.40 % 1048 Springwater Avenue Wenatchee , WA 98801 509-415-7120 Minimum deposit so 7 - day yield ( with waivers ) as of 11/7/22 Call your local Schwab branch at 509-415-7120 or visit schwab.com/wenatchee to find out more . Competitive yields on money market funds and CDs available through Schwab could help you meet your financial goals , and that's always a good thing . charles SCHWAB Own your tomorrow . Certificates of deposit available through Schwab CD OneSource® typically offer a fixed rate of return , although some offer variable rates . They are FDIC - insured and offered through Charles Schwab & Co. , Inc. Investors in money market funds should carefully consider information contained in the prospectus , or , if available , the summary prospectus , including investment objectives , risks , charges , and expenses . You can request a mutual fund prospectus by calling Schwab at 1-800-435-4000 . Please read the prospectus carefully before investing . You could lose money by investing in the Schwab Money Funds . SWVXX seeks to preserve the value of your investment at $ 1.00 per share , but cannot guarantee it will do so . SWVXX may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors . An investment in the Schwab Money Funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency . The Schwab Money Funds ' sponsor has no legal obligation to provide financial support to the Funds , and you should not expect that the sponsor will provide financial support to the Funds at any time . Past performance is no guarantee of future results . For the most recent 7 - day yields , see schwab.com . The 7 - Day Yield is the average income paid out over the previous seven days assuming interest income . is not reinvested and it reflects the effect of all applicable waivers . Absent such waivers , the fund's yield would have been lower . Charles Schwab Investment Management , Inc. ( CSIM ) , the investment advisor for Schwab Funds , and Schwab , Member SIPC , the distributor for Schwab Funds , are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation . © 2022 Charles Schwab & Co. , Inc. All rights reserved . Member SIPC . CC7019834 ( 1122-21V1 ) ADP119092R - 00 ( 09/22 ) 00278560 SCH8640-41